Share:

Are you in the market for a new home purchase in the Flathead Valley of Montana, but wondering if you should hold off on that purchase for now? Flathead Valley Mortgage has put together the following analysis models that outline the difference in the loan amount and monthly payment for the typical borrower in Flathead County. If a buyer were to put down 5% today or wait 3 years to put down 20%. This assumes the borrower uses a 30-year fixed-rate conventional loan.

Assumptions:

The purchase price of the home was based on the typical loan amount from Flathead Valley Mortgage: $554,187K as of August 2022.[1]

Annual property taxes were determined by applying the average county tax rate of .81% to the home price. Estimates for home insurance and mortgage insurance were pulled from MBS Highway. Lastly, closing costs were estimated at 1% of the loan amount.

MBS Highway forecasts a conservative 14.32% appreciation over three years for the typical home in the county bringing the three-year forward forecasted home value to $633,563. The average 30-year rate as of 8/11/22 is 5.22%.[2]

Data:

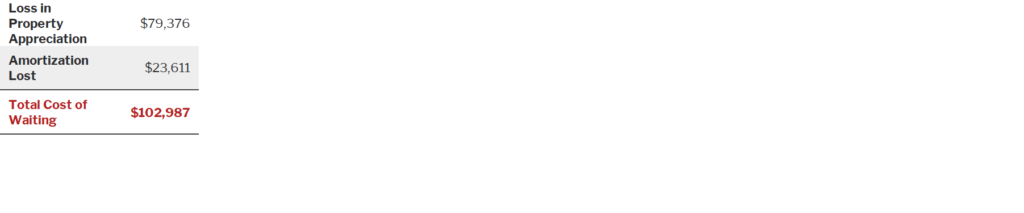

Figure 3 summarizes each loan, including a loan today and a loan in three years at different future interest rates, ranging in 25bp increments from 4% to 6.5%. Figure 1 summarizes the difference in cost, in terms of home price and amortization. With the expected increase in home prices in Flathead County, the loss due to property appreciation would be $79,376. MBS Highway predicts the amortization cost to be $23,611, the difference between the cost of renting for three years and the cost of paying interest for three years on a loan taken today. Rent and interest payments are both “lost” money that do not build equity. This brings the total cost of waiting to $102,987.

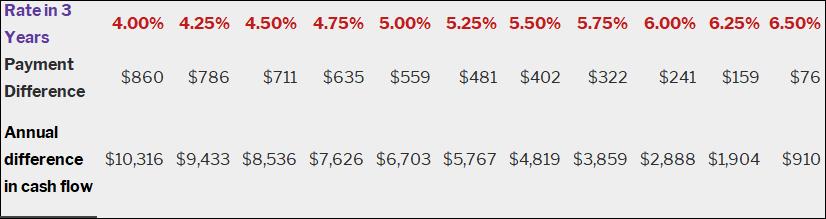

Figure 1 summarizes the difference in the monthly and annual expenses between a loan today and a loan in three years at different future rates. The monthly payment in three years is less than that today in all rate scenarios, ranging from $860 less at a 4% rate to $76 less at 6.5%.

Conclusion:

Despite the high-rate environment today, our data suggests that it is prudent buy a home now with less down than wait three years. This is due to the large appreciation in home prices still anticipated for the Flathead Valley. The 14.32% appreciation rate used in our analysis is quite conservative given that home prices in Flathead County doubled from summer 2020 to summer 2022.[3] The smaller mortgage payments from a larger amount down are most likely insufficient to offset the large expected appreciation in home prices.

Figure 1:

Figure 2:

Figure 3:

[1] Average purchase price of all files closed since the start of 2022.

[2] Freddie Mac

[3] Zillow Home Value Index

Share: