Share:

A Smart Financial Strategy for Homeowners – Save $Hundreds on Your Monthly Payments

An Ideal Solution for Many Homeowners

As we enter 2024, a significant financial opportunity emerges for homeowners with existing mortgages. Those who are grappling with high-interest rates, specifically above 6.5%, or have been managing their mortgage for at least six months, stand to benefit greatly from the FHA and VA Streamline loan programs. This includes recent homeowners who, despite having closed within the last six months, are looking forward to reducing their monthly payments in the near future.

Who Should Consider Streamline Loans?

- Homeowners with High-Interest Rates: If your current mortgage rate is above 6.5%, switching to a Streamline loan can be a game-changer, potentially saving you hundreds of dollars each month.

- Long-term Mortgage Holders: If you closed on your mortgage six months ago or longer, you’re eligible to take advantage of this refinancing opportunity.

- Recent Homeowners Planning Ahead: Even if you’ve only had your mortgage for a short period, it’s wise to start considering how a Streamline loan can benefit you in the near future.

No Need to Wait to Refinance – Start Saving Now!

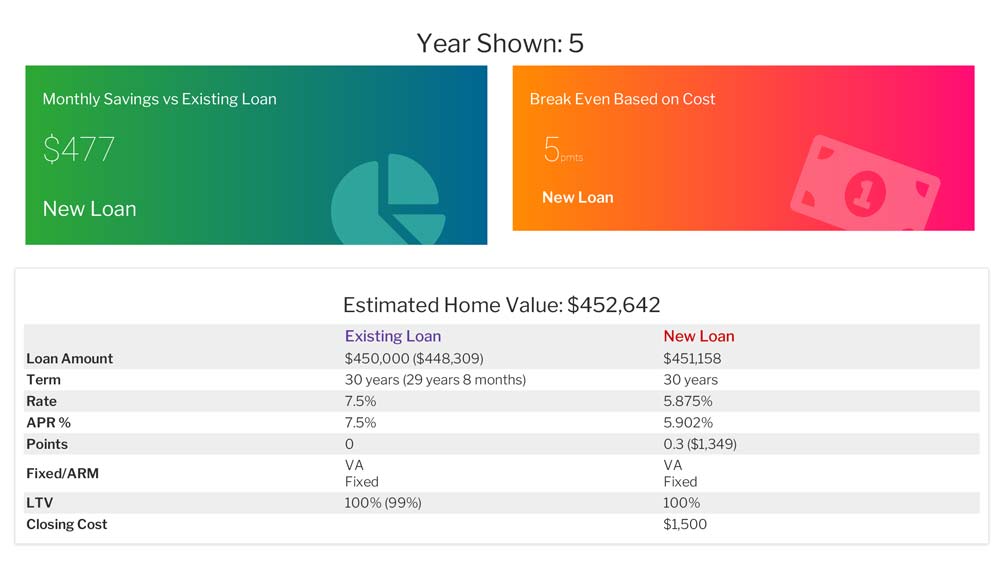

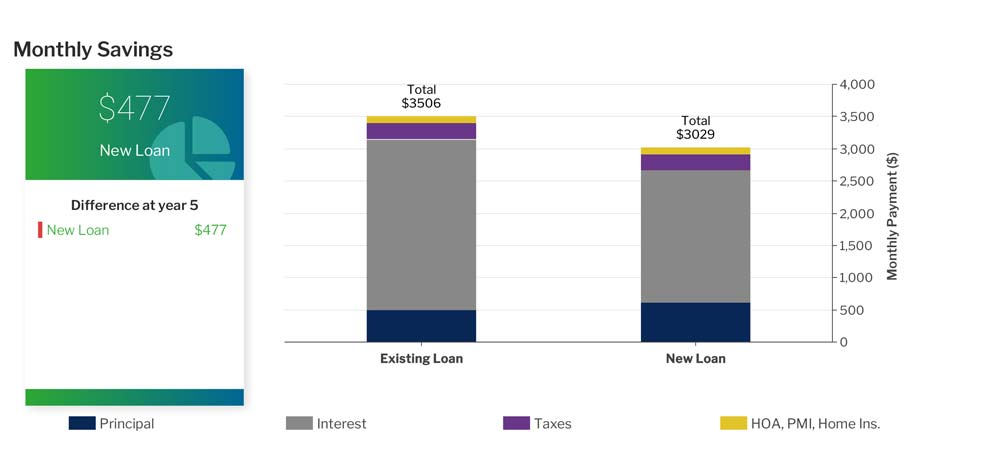

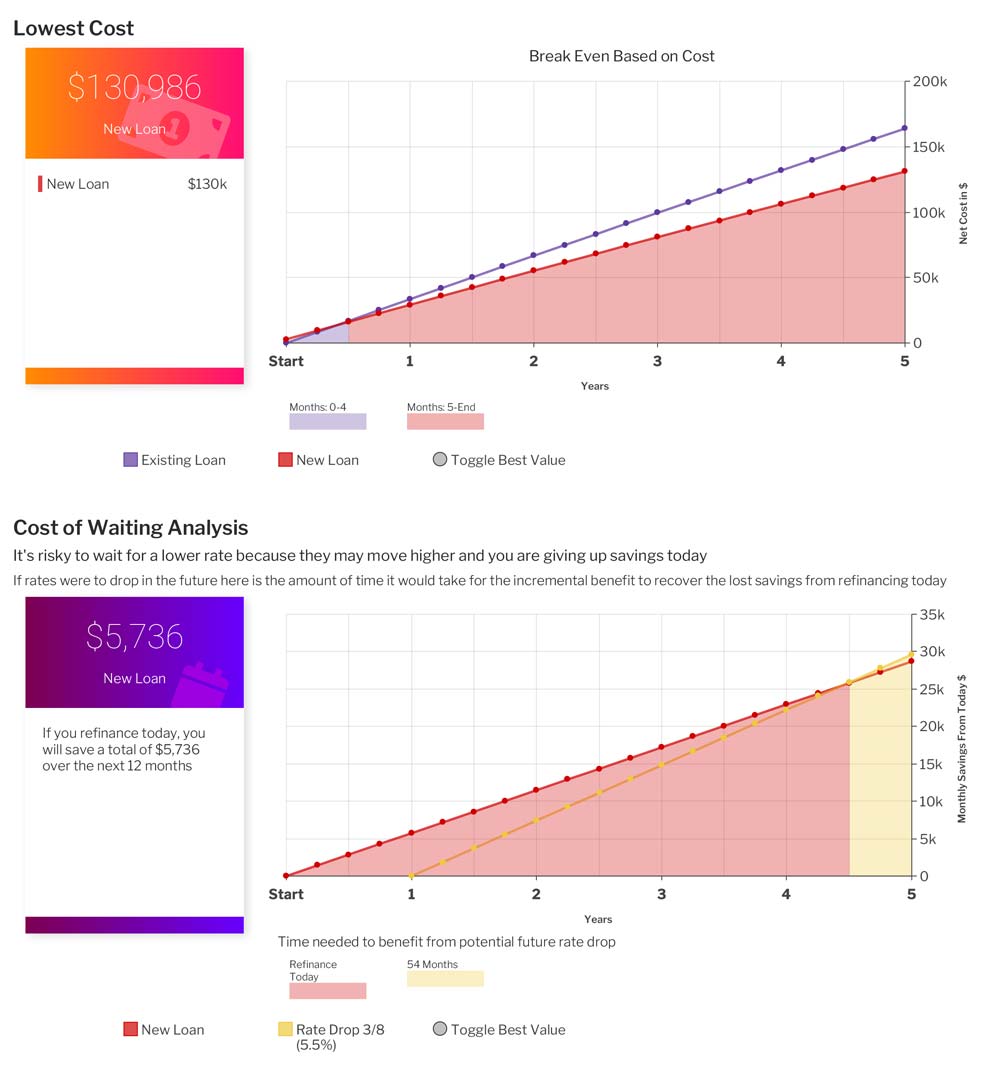

Streamline Refinancing Comparison Example:

The following example shows the savings over time with the new FHA or VA Streamline loan compared to the original higher rate loan. The following also assumes a home value of $452,642 and a borrower with a 720-739 credit score.

Steps to Complete a Streamline Loan

- Understanding the Process: Streamline refinancing is designed for simplicity and efficiency. It allows homeowners to refinance their existing FHA or VA loans with minimal hassle.

- Skipping Income Verification and Appraisal: One of the key advantages of a Streamline loan is the elimination of the need for income verification and property appraisal, which streamlines the process significantly.

- Gathering Minimal Paperwork: The paperwork required for a Streamline loan is considerably less compared to traditional refinancing. You’ll need basic documentation and a mortgage-only credit report.

- Potential Savings: By refinancing through a Streamline loan, you could save substantially on your monthly payments. This reduction in monthly expenses can free up funds for other financial goals or necessities.

Conclusion

In conclusion, FHA and VA Streamline loans present a valuable opportunity for a wide range of homeowners NOW. No need to wait for interest rates to drop to refinance. Whether you’re burdened with a high-interest rate, have been paying your mortgage for a while, or are a recent homeowner looking to improve your financial situation, Streamline loans offer a simplified, cost-effective solution. By reducing paperwork and skipping certain verifications, these loans make refinancing accessible and advantageous, especially in a climate of fluctuating interest rates.

Share: