Share:

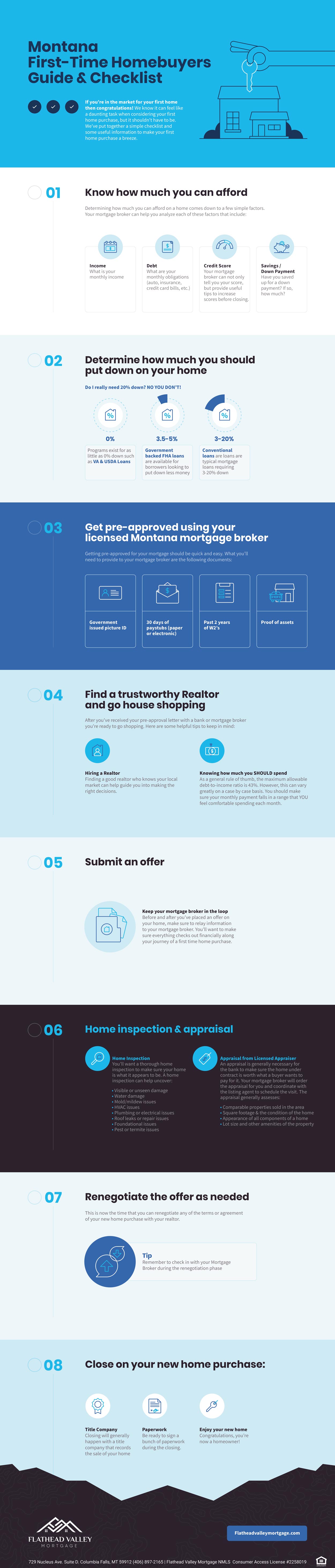

Infographic Available – Click to skip directly to Montana First Time Homebuyer Infographic

Every year, there are countless people in Montana’s Flathead Valley that make the huge step of purchasing their first home. While this is an incredibly exciting step for everyone, it can also be very daunting. That’s why arming yourself with information is incredibly important. After all, a home is likely the most expensive thing you will ever purchase! In order to arm you with information, we’ve put together a guide on everything you need to know about buying your first home.

What Mortgage Programs Exist For a First-Time Home Buyer in Montana?

The state and federal governments know that buying a home can be difficult, especially for those first time Montana home buyers. That’s why there are plenty of first-time home buyer programs out there, especially for those in the Flathead Valley. Aside from traditional mortgages, the main federal programs offered are FHA, USDA, and VA loans. With an FHA loan you can put as little as 3.5% down, or 0% if you’re using a USDA or VA loan. There are also some down payment assistance programs (DPA) that can help by providing forgivable 2nd loans.

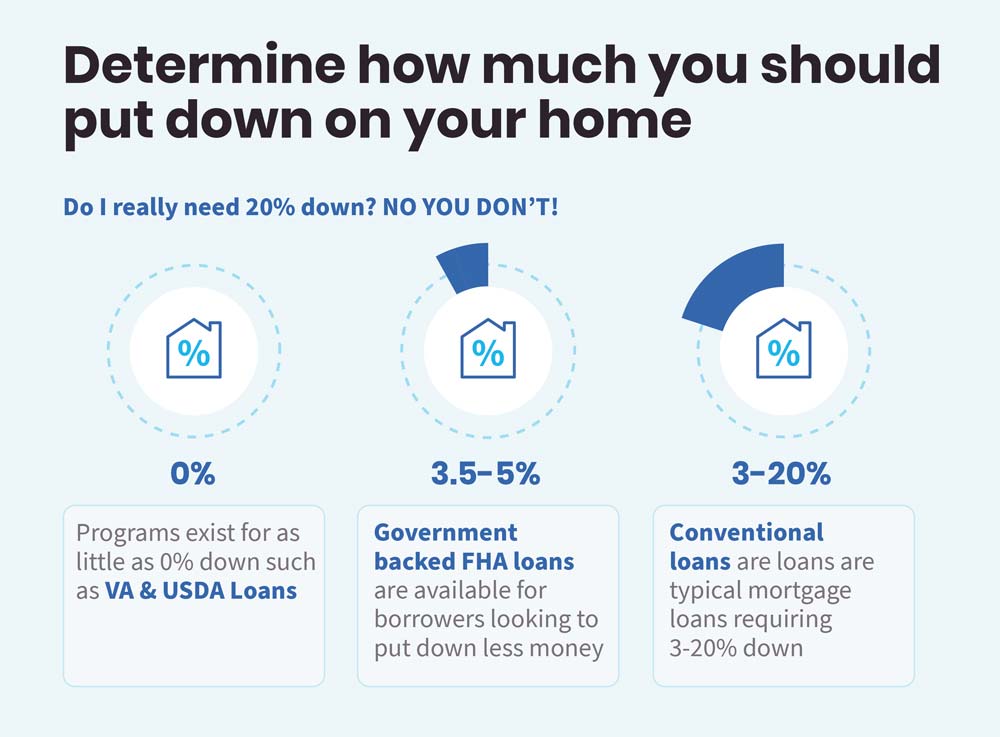

How Much Money Does a First-Time Home Buyer Need To Put Down?

Although many people preach that you need to have 20% of your purchase price, plus closing fees to buy a home, that simply isn’t the truth. Depending on the borrowing program you use, a first-time home buyer only has to put somewhere between 0%-5% (plus closing fees) down on their home. If you are putting less than 20% down, you will have to pay mortgage insurance in the form of PMI or MIP, depending on your program.

However, that should not deter you from purchasing a home. For conventional loans, once you reach 20% equity, you no longer have to pay for mortgage insurance. USDA loans have a very reasonable mortgage insurance rate that is also offset by a lower interest rate. Montana FHA loans also has a lower interest rate when compared to conventional, again offsetting the mortgage insurance payment. You can always refinance into a conventional loan in the future (when there is a net tangible benefit) to remove mortgage insurance. VA loans never carry mortgage insurance.

Should I Put All My Savings Toward a Down Payment?

Generally speaking, it’s probably not a great idea to put all of your savings toward your down payment and closing costs, if possible. That’s because you are probably going to want to have some sort of financial cushion after the deal closes. After all, there are quite a few expenses that you may run into after closing on your house.

For instance, there’s a good chance your home isn’t going to be perfect for you and your family when you close on the house. This means you should have some money available to pay for any necessary repairs or improvements prior to moving in. You might also want a cushion to pay for any moving expenses you may incur, or to cover any potential emergencies that may arise!

Are There Programs in Montana That Make Buying Your First Home More Accessible?

If coming up with the funds for your down payment or closing costs will be tough, don’t worry. There are plenty of programs out there designed to help people just like you. If you find yourself in this situation, you should ask your loan officer about down payment assistance (DPA) programs. These programs will loan you additional funds to cover the down payment or closing costs of your mortgage.

It is important to look at all terms when potentially choosing a DPA program. Understanding the fees and opportunity cost involved with certain DPA programs will make sure you get the best possible terms for your home purchase. Be sure to speak with a licensed loan officer regarding all of your options.

What Does a First-Time Home Buyer Need To Get Approved For a Mortgage in Montana?

Although applying for a mortgage can be daunting at first, it’s really quite simple. All you have to do is provide your Montana mortgage broker (or the bank) with your personal information. While you’re doing this, be sure to have some additional documentation ready, such as a form of picture ID, 30 days of paystubs, your past two years of W-2s,and proof of assets (if requested).

You may be asked for additional documentation throughout the process, such as explanations of any large deposits, however, this is a normal part of the mortgage process. If you are asked to provide additional documentation, be sure to send it over to the bank as soon as possible, as any delays on your end will lead to delays on their end too!

Where Does The Home Buying Process Start?

Before you start looking at homes, you should do a couple of things. The first of which is getting pre-approved by a mortgage lender. This is important, as your pre-approval will determine your budget when hunting for a home. You don’t want to waste your time looking at homes you can’t afford, as this will be upsetting for both you and your realtor – which leads us to our next point.

Another thing you’ll need before you start the home search is a quality realtor. A quality realtor will help you find both areas and homes that you like. Once you find the right home, they will also help you write a competitive offer that (hopefully) gets accepted.

How Much Money Can I Spend On My Home?

Figuring out how much you can spend on your home isn’t as straightforward as it sounds. After all, you and the bank underwriting your loan will have different opinions as to how much you can afford to spend on a home. Your lender will decide how much home you can afford based on your debt-to-income ratio, which is equal to your total debts (car loan, student loans, future mortgage/insurance/property taxes, etc.) divided by your total income.

While it is believed the general maximum allowable debt-to-income ratio is 43%, it greatly varies depending on the lending scenario. You can also use a handy housing affordability calculator to do all of the heavy lifting if you don’t want to do any math. While this is a great tool, the best way to find out how much you can afford is to talk to an experienced licensed loan officer.

Next Steps in the Home Buying Process

After you’ve figured out how much home you can afford, and connected with the perfect realtor, it’s time to actually find a house! Your realtor will bring you to see various homes, and you’ll hopefully find one that you like enough to submit an offer on. Once you find “the one”, your agent will help you assemble the offer, and submit it to the seller’s agent.

Should your offer be accepted, your agent will work with you, the seller, and your mortgage broker to coordinate the inspection/appraisal, and to ensure that everything goes according to plan. Once you are cleared to close, you’ll be given a closing date by your mortgage broker, and your agent will likely accompany you on your big day!

Montana First Time Homebuyers Guide – Infographic:

For informational purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.

Share: